📈 Limited Opportunity: Invest in Early Lung Cancer Detection

📈 Limited Opportunity: Invest in Early Lung Cancer Detection

📈 Limited Opportunity: Invest in Early Lung Cancer Detection

Detect Early: Save Lives

📈 Limited Opportunity: Invest in Early Lung Cancer Detection

Detect Early: Save Lives

HEAR FROM OUR SCIENTIFIC TEAM

Invest in the Future of Cancer Detection

Invest in the Future of Cancer Detection

Invest in the Future of Cancer Detection

Cizzle Bio is driving a new era in early cancer detection with two breakthrough blood tests—CIZ1B for early-stage lung cancer and DEX-G2 for gastric cancer, two of the deadliest cancers worldwide.

These simple, minimally invasive tests detect cancer early—far earlier than traditional methods—when treatment is more effective and outcomes improve.

Backed by leading U.S. cancer centers, protected by a strong patent portfolio, and preparing for commercial launch in CLIA-certified labs, we are at the threshold of delivering life-saving innovation at scale.

Now is your chance to invest in a company with clinical validation, cutting-edge science, and a clear path to market.

Cizzle Bio is driving a new era in early cancer detection with two breakthrough blood tests—CIZ1B for early-stage lung cancer and DEX-G2 for gastric cancer, two of the deadliest cancers worldwide.

These simple, minimally invasive tests detect cancer early—far earlier than traditional methods—when treatment is more effective and outcomes improve.

Backed by leading U.S. cancer centers, protected by a strong patent portfolio, and preparing for commercial launch in CLIA-certified labs, we are at the threshold of delivering life-saving innovation at scale.

Now is your chance to invest in a company with clinical validation, cutting-edge science, and a clear path to market.

Cizzle Bio is driving a new era in early cancer detection with two breakthrough blood tests—CIZ1B for early-stage lung cancer and DEX-G2 for gastric cancer, two of the deadliest cancers worldwide.

These simple, minimally invasive tests detect cancer early—far earlier than traditional methods—when treatment is more effective and outcomes improve.

Backed by leading U.S. cancer centers, protected by a strong patent portfolio, and preparing for commercial launch in CLIA-certified labs, we are at the threshold of delivering life-saving innovation at scale.

Now is your chance to invest in a company with clinical validation, cutting-edge science, and a clear path to market.

$0.38

$0.38

Share Price

$750

Minimum Investment

$750

Minimum Investment

$750

Minimum

Investment

$163,000+

$163,000+

Total Crowdfunded

$163,000+

Total Crowdfunded

$3.95 M+

$3.95 M+

Raised

$3.95 M+

Raised

FAST FACTS

FAST FACTS

FAST FACTS

FAST FACTS

95% Sensitive

95% Sensitive

95% Sensitive

Our CIZ1B and DEX-G2 Biomarker test shows remarkable accuracy in early clinical studies for detecting early-stage cancer.

Our CIZ1B and DEX-G2 Biomarker test shows remarkable accuracy in early clinical studies for detecting early-stage cancer.

Our CIZ1B and DEX-G2 Biomarker test shows remarkable accuracy in early clinical studies for detecting early-stage cancer.

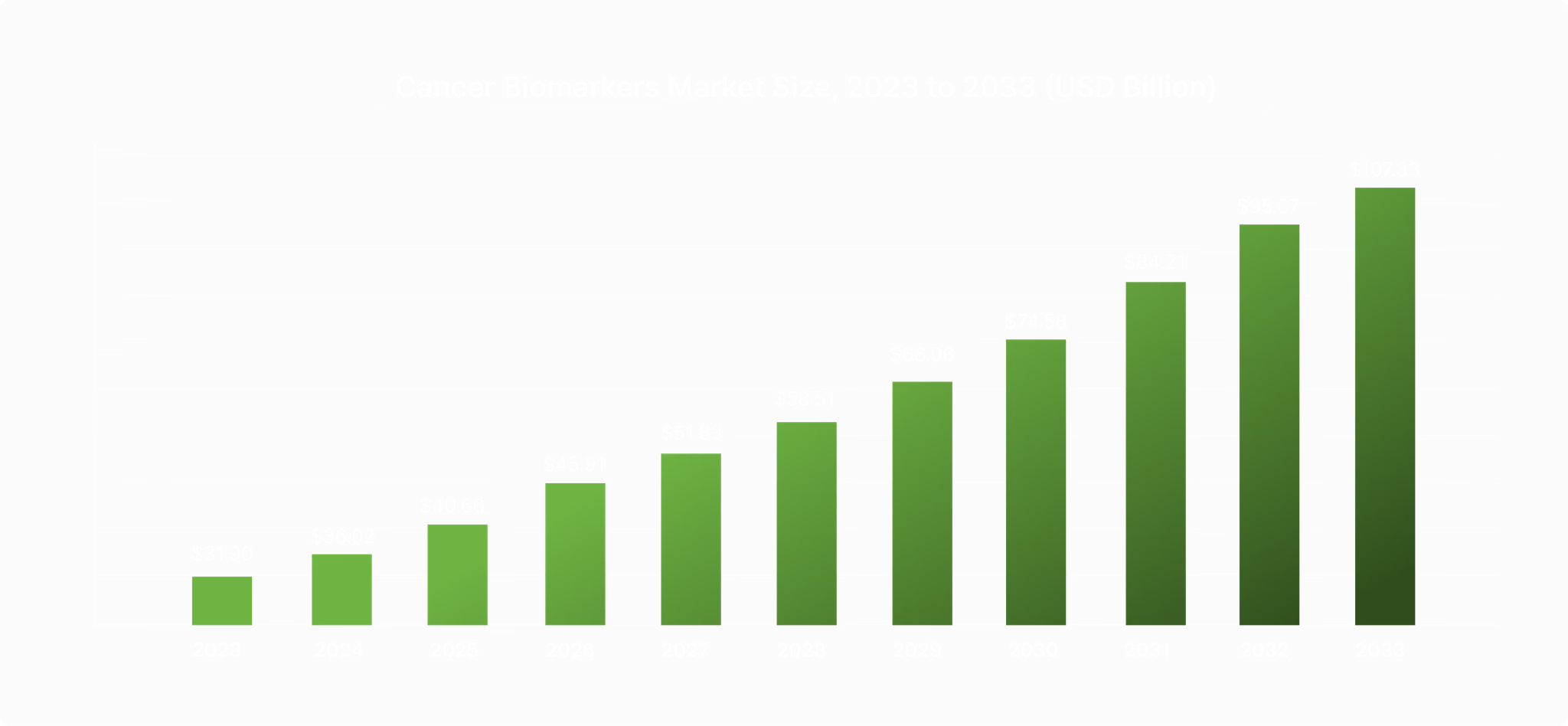

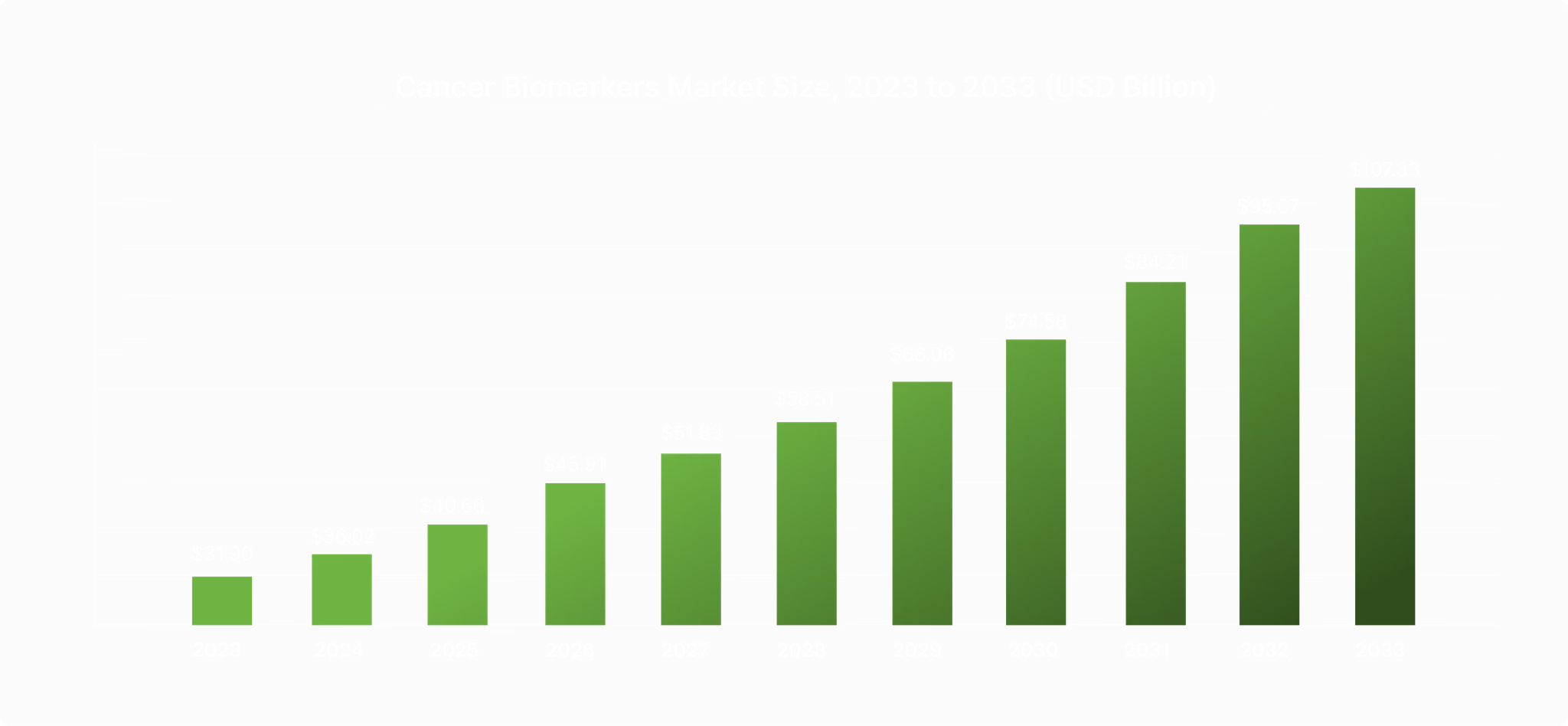

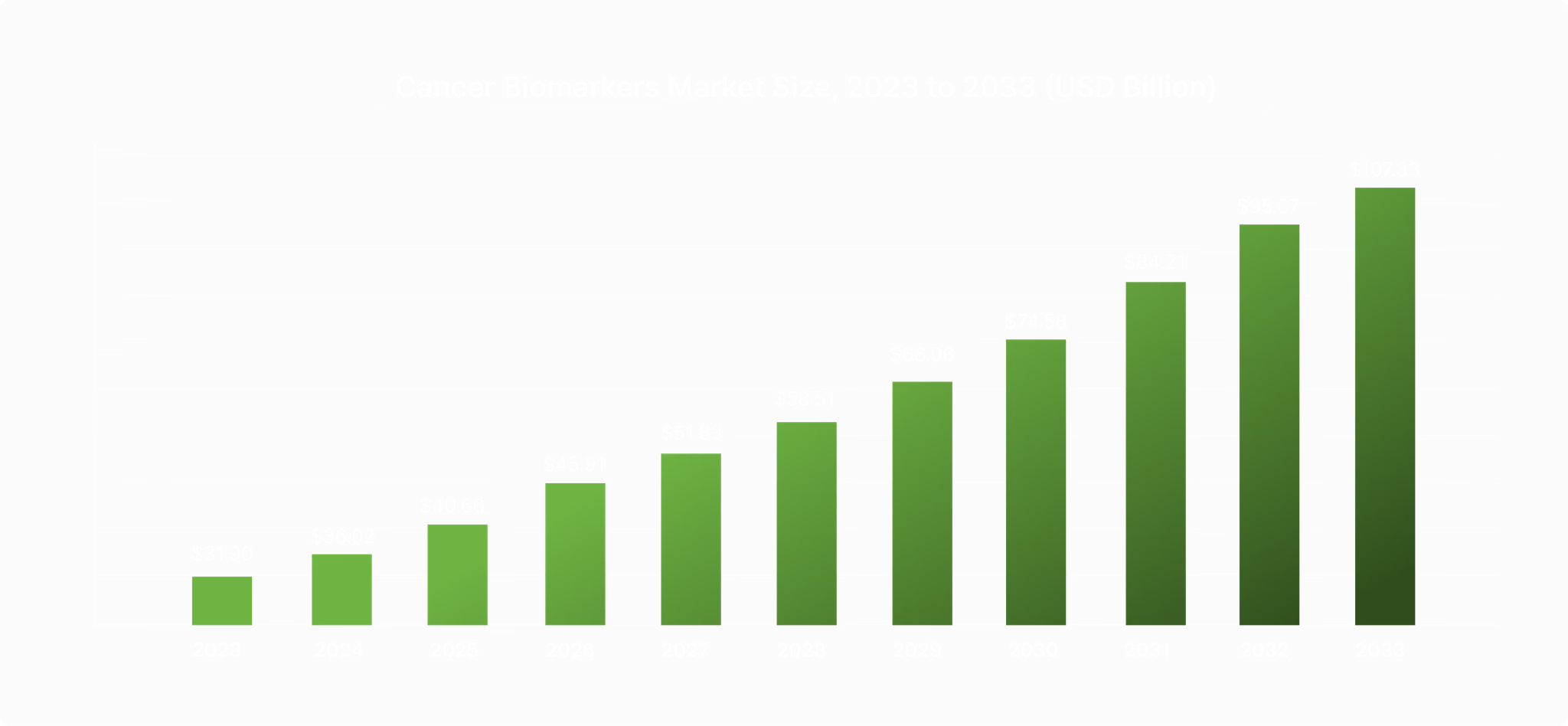

$95B+ Market

$95B+ Market

$95B+ Market

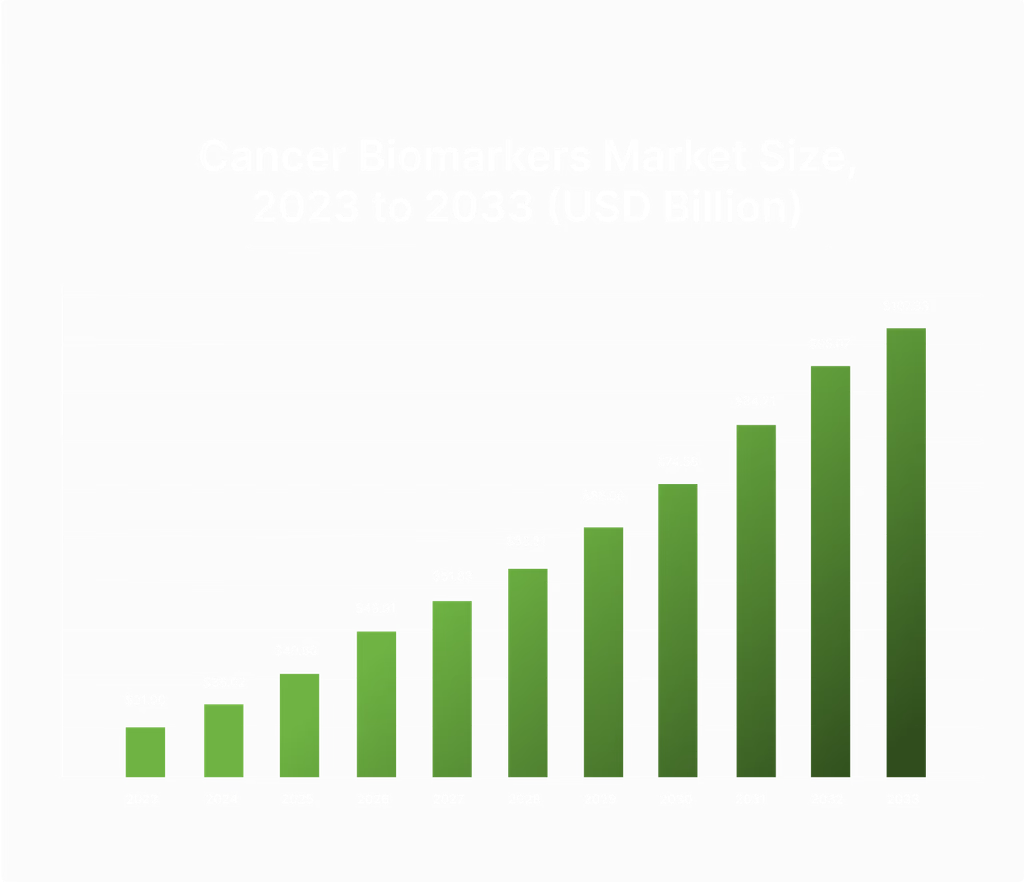

The global cancer biomarker market estimated to reach $95B by 2032, with a CAGR of 12.9% in the growth period. Source here

Urgent Clinical Need

Urgent Clinical Need

Urgent Clinical Need

Together, lung and gastric cancer claim more than 2.5 million lives each year—most diagnosed too late for effective treatment. We offer early, life-saving detection.

Together, lung and gastric cancer claim more than 2.5 million lives each year—most diagnosed too late for effective treatment. We offer early, life-saving detection.

Together, lung and gastric cancer claim more than 2.5 million lives each year—most diagnosed too late for effective treatment. We offer early, life-saving detection.

Prestigious Research Partnerships

Emerging Site

Washington, DC

Emerging Site

Validating

Durham, NC

Validating

Validating

Los Angeles, CA

Validating

Newport Beach, CA

Validating

San Antonio, TX

Validating

Tampa, FL

Clinical Validation at Top U.S. Cancer Centers

FEATURED IN

FEATURED IN

Learn how Cizzle Bio can save lives through early detection testing.

Learn how Cizzle Bio can save lives

through early detection testing.

Learn how Cizzle Bio can save lives through early detection testing.

Get the Cizzle Bio Investor Deck.

Get the Cizzle Bio Investor Deck.

Get the Cizzle Bio Investor Deck.

PROBLEM

PROBLEM

PROBLEM

PROBLEM

Lung Cancer is the Deadliest Cancer Worldwide

Lung Cancer is the Deadliest

Cancer Worldwide

Lung Cancer is the Deadliest

Cancer Worldwide

Late detection leads to high mortality rates.

Late detection leads to high mortality rates.

Late detection leads to high mortality rates.

Every day, nearly 5,000 lives are lost to late-stage diagnoses. Approximately 75% of lung cancer cases are diagnosed at a late stage, drastically reducing survival rates.

Every day, nearly 5,000 lives are lost to late-stage diagnoses. Approximately 75% of lung cancer cases are diagnosed at a late stage, drastically reducing survival rates.

Every day, nearly 5,000 lives are lost to late-stage diagnoses. Approximately 75% of lung cancer cases are diagnosed at a late stage, drastically reducing survival rates.

The odds are startling: 1 in 16 individuals will be diagnosed with lung cancer at some point in their lives.

Learn more at the Lung Cancer Foundation of America.

The odds are startling: 1 in 16 individuals will be diagnosed with lung cancer at some point in their lives.

Learn more at the Lung Cancer Foundation of America.

The odds are startling: 1 in 16 individuals will be diagnosed with lung cancer at some point in their lives.

Learn more at the Lung Cancer Foundation of America.

SOLUTION

SOLUTION

SOLUTION

SOLUTION

Introducing the CIZ1B Biomarker Test: A Breakthrough in Early Lung Cancer Detection

Introducing the CIZ1B Biomarker Test: A Breakthrough in Early Lung Cancer Detection

Introducing the CIZ1B Biomarker Test: A Breakthrough in Early Lung Cancer Detection

The screening tool patients need and healthcare systems demand. Our CIZ1B Biomarker test offers a simple blood test for early-stage lung cancer detection with 95% sensitivity in early clinical studies.

Low Cost

Highly Accurate

Minimally Invasive

Rapid Results

The screening tool patients need and healthcare systems demand. Our CIZ1B Biomarker test offers a simple blood test for early-stage lung cancer detection with 95% sensitivity in early clinical studies.

Low Cost

Highly Accurate

Minimally Invasive

Rapid Results

The screening tool patients need and healthcare systems demand. Our CIZ1B Biomarker test offers a simple blood test for early-stage lung cancer detection with 95% sensitivity in early clinical studies.

Low Cost

Highly Accurate

Minimally Invasive

Rapid Results

Detecting Early Saves Lives

Detecting Early Saves Lives

Detecting Early Saves Lives

Lung cancer can take many years to be symptomatic when it is at an advanced stage. It is often the case that people who develop lung cancer don't visit a medical care facility for screening until it's too late. Cizzle Bio's technology would allow at risk patients to test preventatively, significantly reducing risk of late detection.

Lung cancer can take many years to be symptomatic when it is at an advanced stage. It is often the case that people who develop lung cancer don't visit a medical care facility for screening until it's too late. Cizzle Bio's technology would allow at risk patients to test preventatively, significantly reducing risk of late detection.

Lung cancer can take many years to be symptomatic when it is at an advanced stage. It is often the case that people who develop lung cancer don't visit a medical care facility for screening until it's too late. Cizzle Bio's technology would allow at risk patients to test preventatively, significantly reducing risk of late detection.

AT RISK

Symptoms

Imaging

Biopsy

Treatment

Recurrence

MARKET

MARKET

MARKET

MARKET

Capturing a $95B+ Opportunity in

Rapidly Growing Diagnostics Market

Capturing a $95B+ Opportunity in

Rapidly Growing Diagnostics Market

Capturing a $95B+ Opportunity in

Rapidly Growing Diagnostics Market

The cancer biomarkers market is set to grow from $31.90 billion in 2023 to $107.33 billion by 2033, fueled by the rising demand for early detection and precision diagnostics. Cizzle is uniquely positioned to tap into this $95B+ market with its focus on advancing early lung cancer detection through biomarker technology.

The cancer biomarkers market is set to grow from $31.90 billion in 2023 to $107.33 billion by 2033, fueled by the rising demand for early detection and precision diagnostics. Cizzle is uniquely positioned to tap into this $95B+ market with its focus on advancing early lung cancer detection through biomarker technology.

The cancer biomarkers market is set to grow from $31.90 billion in 2023 to $107.33 billion by 2033, fueled by the rising demand for early detection and precision diagnostics. Cizzle is uniquely positioned to tap into this $95B+ market with its focus on advancing early lung cancer detection through biomarker technology.

BUSINESS MODEL

BUSINESS MODEL

BUSINESS MODEL

BUSINESS MODEL

Advancing Lung Cancer Diagnostics with CIZ1B to $33.8M/Yr Revenue by Year Three*

Advancing Lung Cancer Diagnostics with CIZ1B to $33.8M/Yr Revenue by Year Three*

Advancing Lung Cancer Diagnostics with CIZ1B to $33.8M/Yr Revenue by Year Three*

Cizzle Bio's business model is powered by our proprietary CIZ1B blood test for early-stage lung cancer detection, generating revenue through initial test deployment, clinical diagnostics usage, and high-value royalties.

Based on our projections, we are poised to achieve:*

$10K to $1.4M revenue growth from lab tests in Year 1

$340K to $1.2M POC test revenue in Year 1

Recurring revenue reaching $4.6M by Year 3

2,033% YoY revenue growth from Year 2 to Year 3

Net royalty scaling to $4.6M by final month of Year 3

*Future projections are not guaranteed results.

Cizzle Bio's business model is powered by our proprietary CIZ1B blood test for early-stage lung cancer detection, generating revenue through initial test deployment, clinical diagnostics usage, and high-value royalties.

Based on our projections, we are poised to achieve:*

$10K to $1.4M revenue growth from lab tests in Year 1

$340K to $1.2M POC test revenue in Year 1

Recurring revenue reaching $4.6M by Year 3

2,033% YoY revenue growth from Year 2 to Year 3

Net royalty scaling to $4.6M by final month of Year 3

*Future projections are not guaranteed results.

Cizzle Bio's business model is powered by our proprietary CIZ1B blood test for early-stage lung cancer detection, generating revenue through initial test deployment, clinical diagnostics usage, and high-value royalties.

Based on our projections, we are poised to achieve:*

$10K to $1.4M revenue growth from lab tests in Year 1

$340K to $1.2M POC test revenue in Year 1

Recurring revenue reaching $4.6M by Year 3

2,033% YoY revenue growth from Year 2 to Year 3

Net royalty scaling to $4.6M by final month of Year 3

*Future projections are not guaranteed results.

COMPETITION

COMPETITION

COMPETITION

COMPETITION

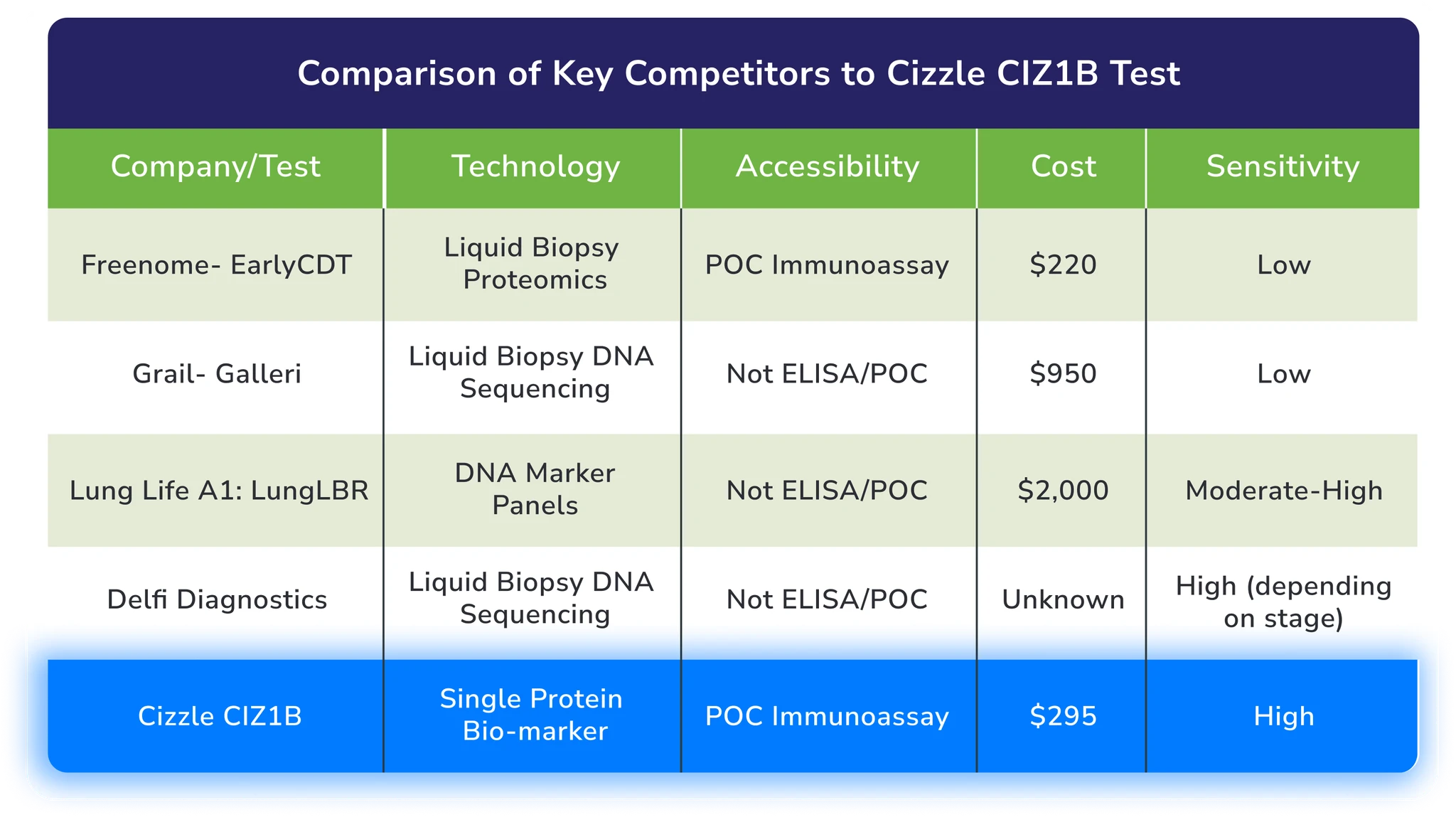

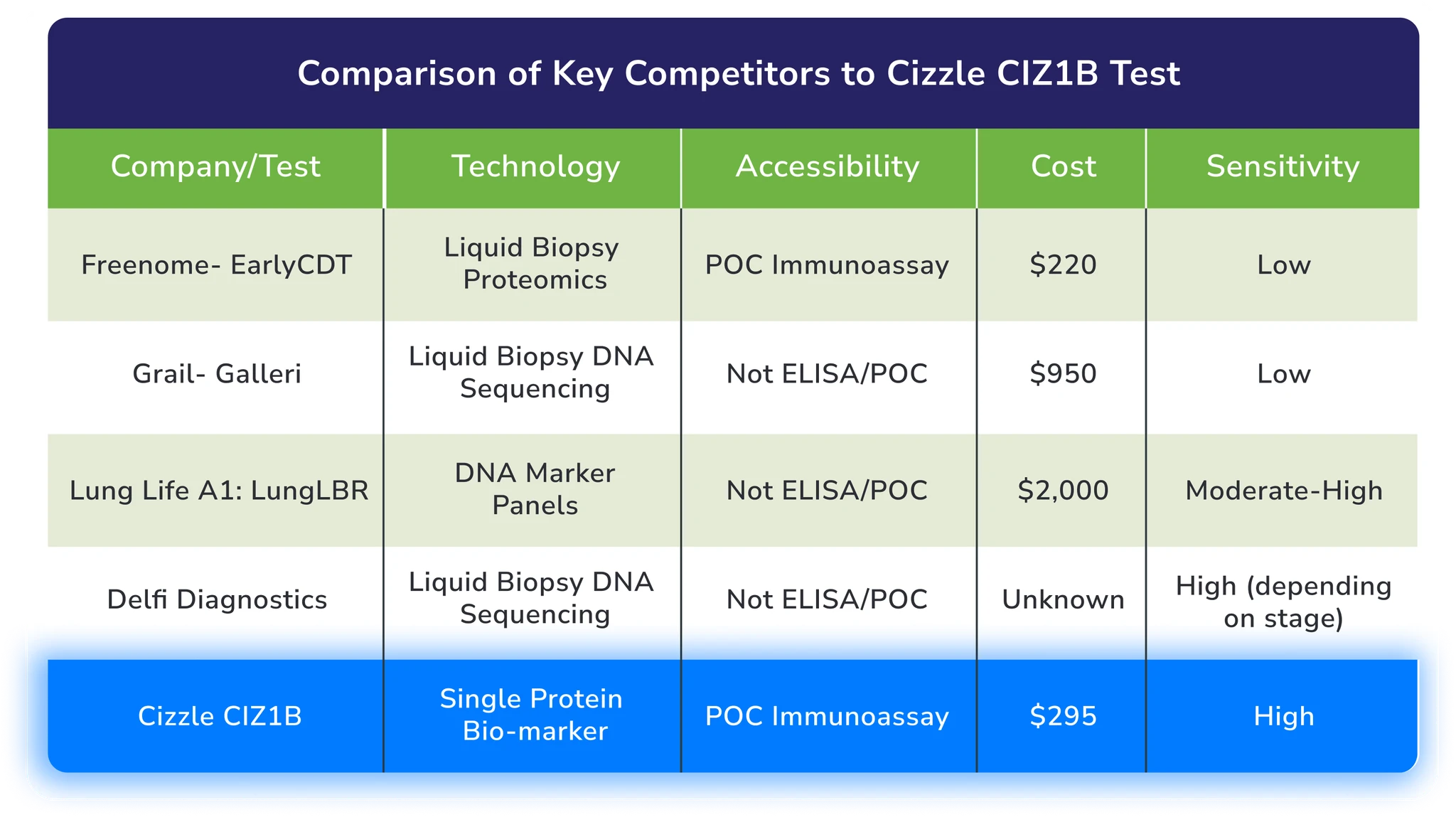

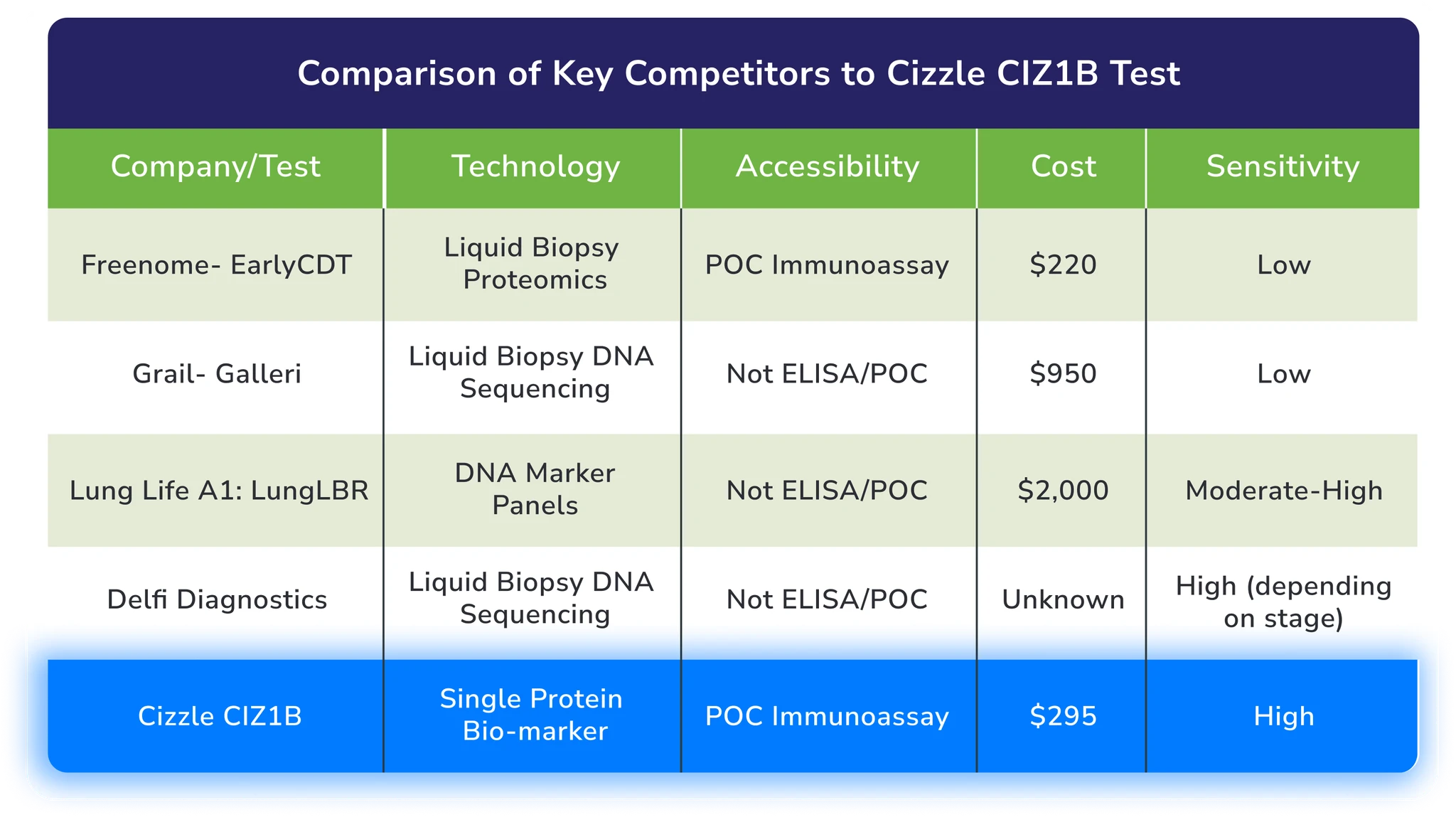

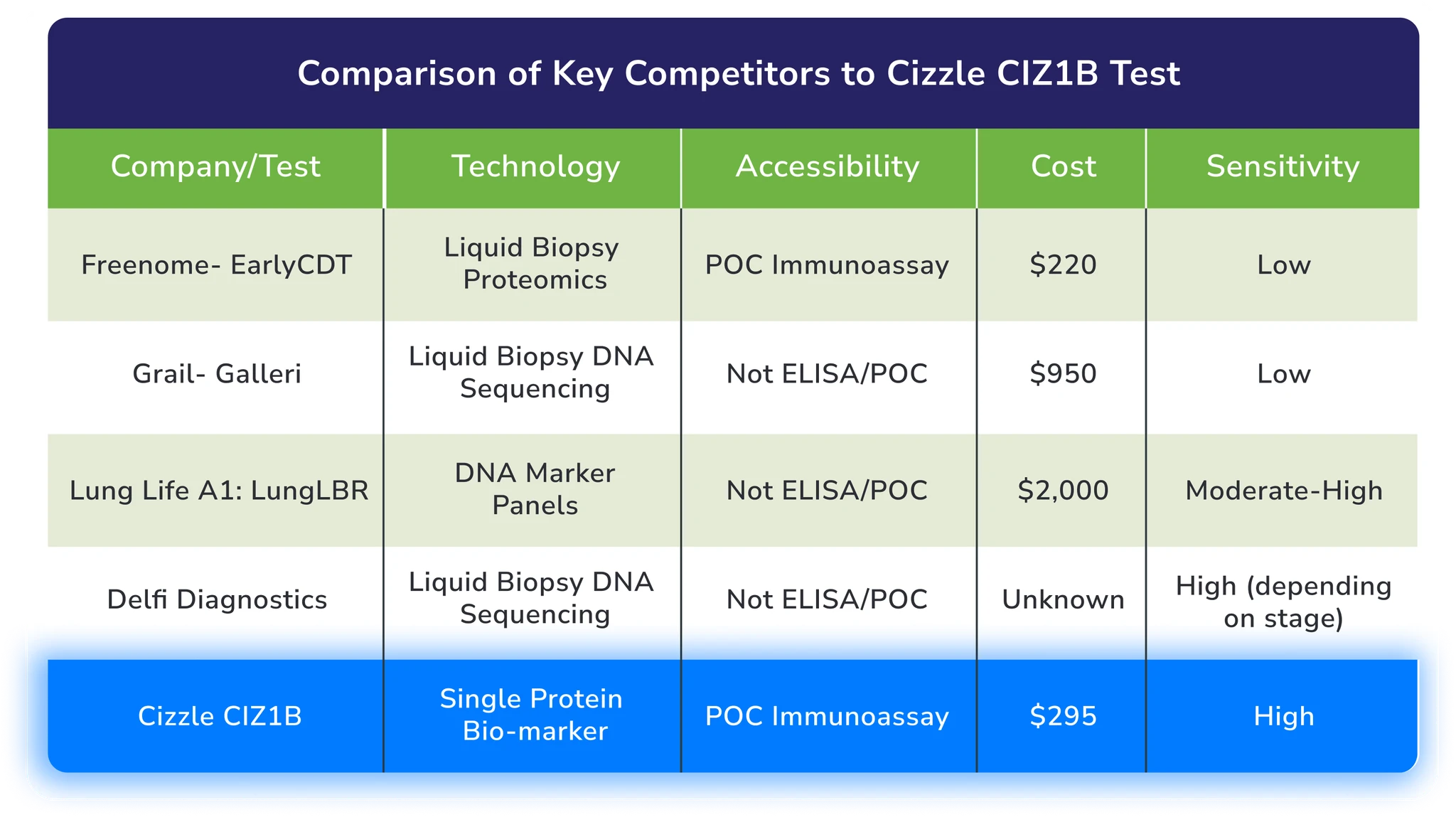

Unrivaled in Accuracy, Simplicity, and Cost-Effectiveness

Unrivaled in Accuracy, Simplicity, and Cost-Effectiveness

Unrivaled in Accuracy, Simplicity, and Cost-Effectiveness

While competitors struggle with invasive procedures and high false-positive rates, Cizzle Bio's CIZ1B Biomarker test offers unparalleled capabilities. Our test delivers early detection with 95% sensitivity – significantly more accurate than current methods, with exceptional ease-of-use and cost-effectiveness.

While competitors struggle with invasive procedures and high false-positive rates, Cizzle Bio's CIZ1B Biomarker test offers unparalleled capabilities. Our test delivers early detection with 95% sensitivity – significantly more accurate than current methods, with exceptional ease-of-use and cost-effectiveness.

While competitors struggle with invasive procedures and high false-positive rates, Cizzle Bio's CIZ1B Biomarker test offers unparalleled capabilities. Our test delivers early detection with 95% sensitivity – significantly more accurate than current methods, with exceptional ease-of-use and cost-effectiveness.

TEAM

TEAM

TEAM

TEAM

Biotech and Healthcare Experts

Leading the Charge

Biotech and Healthcare Experts

Leading the Charge

Biotech and Healthcare Experts Leading the Charge

Bill Behnke

Bill Behnke

Bill Behnke

CHAIRMAN & CEO

CHAIRMAN & CEO

CHAIRMAN & CEO

Has raised over $100M in capital and is an expert in business development. Worked with major cancer charities and health insurers, including the Leukemia and Lymphoma Society.

Has raised over $100M in capital and is an expert in business development. Worked with major cancer charities and health insurers, including the Leukemia and Lymphoma Society.

Has raised over $100M in capital and is an expert in business development. Worked with major cancer charities and health insurers, including the Leukemia and Lymphoma Society.

Dr. Ron Greeno

Dr. Ron Greeno

Dr. Ron Greeno

MD, FCCP, MHM

NON-EXECUTIVE DIRECTOR

MD, FCCP, MHM

NON-EXECUTIVE DIRECTOR

MD, FCCP, MHM

NON-EXECUTIVE DIRECTOR

Founder of Cogent Healthcare, and a recognized leader in physician services. Served as a strategic healthcare policy advisor on Capitol Hill, Medicare, and CMMI.

Founder of Cogent Healthcare, and a recognized leader in physician services. Served as a strategic healthcare policy advisor on Capitol Hill, Medicare, and CMMI.

Founder of Cogent Healthcare, and a recognized leader in physician services. Served as a strategic healthcare policy advisor on Capitol Hill, Medicare, and CMMI.

Mary Jimenez

Mary Jimenez

Mary Jimenez

EXECUTIVE VICE PRESIDENT,

BUSINESS DEVELOPMENT

EXECUTIVE VICE PRESIDENT,

BUSINESS DEVELOPMENT

EXECUTIVE VICE PRESIDENT,

BUSINESS DEVELOPMENT

Former executive at Genentech and Caris, specializing in biotech sales. Has led successful business strategies and sales teams in the biotechnology sector.

Former executive at Genentech and Caris, specializing in biotech sales. Has led successful business strategies and sales teams in the biotechnology sector.

Former executive at Genentech and Caris, specializing in biotech sales. Has led successful business strategies and sales teams in the biotechnology sector.

Dr. Allan Syms

Dr. Allan Syms

Dr. Allan Syms

Executive Chairman

Executive Chairman

Executive Chairman

Over 30 years of experience in biotech, leading companies from a to IPO. Former Corporate Marketing Director at Integra Biosciences AG.

Over 30 years of experience in biotech, leading companies from a to IPO. Former Corporate Marketing Director at Integra Biosciences AG.

Over 30 years of experience in biotech, leading companies from a to IPO. Former Corporate Marketing Director at Integra Biosciences AG.

Nigel Lee

Nigel Lee

Nigel Lee

FCA

FCA

FCA

Director of CFO Solutions Ltd., providing financial advisory services. Held senior management roles at PricewaterhouseCoopers, overseeing financial operations for biotech initiatives.

Director of CFO Solutions Ltd., providing financial advisory services. Held senior management roles at PricewaterhouseCoopers, overseeing financial operations for biotech initiatives.

Director of CFO Solutions Ltd., providing financial advisory services. Held senior management roles at PricewaterhouseCoopers, overseeing financial operations for biotech initiatives.

Prof. Dawn Coverely

Prof. Dawn Coverely

Prof. Dawn Coverely

FOUNDER

FOUNDER

FOUNDER

Cancer biologist and founder of Cizzle Biotechnology. Known for significant contributions to oncology research and the development of cancer screening technologies.

Cancer biologist and founder of Cizzle Biotechnology. Known for significant contributions to oncology research and the development of cancer screening technologies.

Cancer biologist and founder of Cizzle Biotechnology. Known for significant contributions to oncology research and the development of cancer screening technologies.

GO TO MARKET

GO TO MARKET

GO TO MARKET

GO TO MARKET

Streamlined Product Roadmap to Revenue

Streamlined Product Roadmap to Revenue

Streamlined Product Roadmap to Revenue

Clinical and Regulatory

Clinical and Regulatory

Clinical and Regulatory

Objective: Complete additional clinical trials where necessary, complete CLIA (Clinical Laboratory Improvement Amendments) certification for LDTs (Laboratory Developed Tests), and secure insurance reimbursement pathways.

Objective: Complete additional clinical trials where necessary, complete CLIA (Clinical Laboratory Improvement Amendments) certification for LDTs (Laboratory Developed Tests), and secure insurance reimbursement pathways.

Objective: Complete additional clinical trials where necessary, complete CLIA (Clinical Laboratory Improvement Amendments) certification for LDTs (Laboratory Developed Tests), and secure insurance reimbursement pathways.

1

1

1

Launch and Early

Adoption

Launch and Early

Adoption

Launch and Early

Adoption

Objective: Begin scaling manufacturing and commercialization efforts. Focus on partnerships with hospitals and research institutions for early adoption.

Objective: Begin scaling manufacturing and commercialization efforts. Focus on partnerships with hospitals and research institutions for early adoption.

Objective: Begin scaling manufacturing and commercialization efforts. Focus on partnerships with hospitals and research institutions for early adoption.

2

2

2

Scaling and Market Capture

Scaling and Market Capture

Scaling and Market Capture

Objective: Achieve target SOM market penetration in the U.S., supported by strong data and partnerships. Expand diagnostic portfolio to include early detection tests for pancreatic, colon, esophageal cancers, and Alzheimer’s.

Objective: Achieve target SOM market penetration in the U.S., supported by strong data and partnerships. Expand diagnostic portfolio to include early detection tests for pancreatic, colon, esophageal cancers, and Alzheimer’s.

Objective: Achieve target SOM market penetration in the U.S., supported by strong data and partnerships. Expand diagnostic portfolio to include early detection tests for pancreatic, colon, esophageal cancers, and Alzheimer’s.

3

3

3

FAQ

FAQ

FAQ

HOW MUCH CAN I INVEST?

HOW MUCH CAN I INVEST?

HOW MUCH CAN I INVEST?

HOW MUCH CAN I INVEST?

HOW DO I CALCULATE MY NET WORTH?

HOW DO I CALCULATE MY NET WORTH?

HOW DO I CALCULATE MY NET WORTH?

HOW DO I CALCULATE MY NET WORTH?

WHAT ARE THE TAX IMPLICATIONS OF AN EQUITY CROWDFUNDING INVESTMENT?

WHAT ARE THE TAX IMPLICATIONS OF AN EQUITY CROWDFUNDING INVESTMENT?

WHAT ARE THE TAX IMPLICATIONS OF AN EQUITY CROWDFUNDING INVESTMENT?

WHAT ARE THE TAX IMPLICATIONS OF AN EQUITY CROWDFUNDING INVESTMENT?

WHO CAN INVEST IN A REGULATION CF OFFERING?

WHO CAN INVEST IN A REGULATION CF OFFERING?

WHO CAN INVEST IN A REGULATION CF OFFERING?

WHO CAN INVEST IN A REGULATION CF OFFERING?

WHAT DO I NEED TO KNOW ABOUT EARLY-STAGE INVESTING? ARE THESE INVESTMENTS RISKY?

WHAT DO I NEED TO KNOW ABOUT EARLY-STAGE INVESTING? ARE THESE INVESTMENTS RISKY?

WHAT DO I NEED TO KNOW ABOUT EARLY-STAGE INVESTING? ARE THESE INVESTMENTS RISKY?

WHAT DO I NEED TO KNOW ABOUT EARLY-STAGE INVESTING? ARE THESE INVESTMENTS RISKY?

CAN I SELL MY UNITS?

CAN I SELL MY UNITS?

CAN I SELL MY UNITS?

CAN I SELL MY UNITS?

WHAT HAPPENS IF A COMPANY DOES NOT REACH THEIR FUNDING TARGET?

WHAT HAPPENS IF A COMPANY DOES NOT REACH THEIR FUNDING TARGET?

WHAT HAPPENS IF A COMPANY DOES NOT REACH THEIR FUNDING TARGET?

WHAT HAPPENS IF A COMPANY DOES NOT REACH THEIR FUNDING TARGET?

HOW CAN I LEARN MORE ABOUT A COMPANY’S OFFERING?

HOW CAN I LEARN MORE ABOUT A COMPANY’S OFFERING?

HOW CAN I LEARN MORE ABOUT A COMPANY’S OFFERING?

HOW CAN I LEARN MORE ABOUT A COMPANY’S OFFERING?

WHAT IF I CHANGE MY MIND ABOUT INVESTING?

WHAT IF I CHANGE MY MIND ABOUT INVESTING?

WHAT IF I CHANGE MY MIND ABOUT INVESTING?

WHAT IF I CHANGE MY MIND ABOUT INVESTING?

HOW CAN I KEEP UP WITH HOW THE COMPANY IS DOING?

HOW CAN I KEEP UP WITH HOW THE COMPANY IS DOING?

HOW CAN I KEEP UP WITH HOW THE COMPANY IS DOING?

HOW CAN I KEEP UP WITH HOW THE COMPANY IS DOING?

WHAT RELATIONSHIP DOES THE COMPANY HAVE WITH DEALMAKER SECURITIES?

WHAT RELATIONSHIP DOES THE COMPANY HAVE WITH DEALMAKER SECURITIES?

WHAT RELATIONSHIP DOES THE COMPANY HAVE WITH DEALMAKER SECURITIES?

WHAT RELATIONSHIP DOES THE COMPANY HAVE WITH DEALMAKER SECURITIES?

WHAT IS THE MINIMUM INVESTMENT AMOUNT?

WHAT IS THE MINIMUM INVESTMENT AMOUNT?

WHAT IS THE MINIMUM INVESTMENT AMOUNT?

WHAT IS THE MINIMUM INVESTMENT AMOUNT?

DISCLAIMER: Equity crowdfunding investments in private placements, and start-up investments in particular, are speculative and involve a high degree of risk and those investors who cannot afford to lose their entire investment should not invest in start-ups. Companies seeking startup investment through equity crowdfunding tend to be in earlier stages of development and their business model, products and services may not yet be fully developed, operational or tested in the public marketplace. There is no guarantee that the stated valuation and other terms are accurate or in agreement with the market or industry valuations. Further, investors may receive illiquid and/or restricted stock that may be subject to holding period requirements and/or liquidity concerns.

DealMaker Securities LLC, a registered broker-dealer, and member of FINRA | SIPC, located at 4000 Eagle Point Corporate Drive, Suite 950, Birmingham, AL 35242., is the Intermediary for this offering and is not an affiliate of or connected with the Issuer. Please check our background on FINRA's BrokerCheck.

DealMaker Securities LLC does not make investment recommendations.

DealMaker Securities LLC is NOT placing or selling these securities on behalf of the Issuer.

DealMaker Securities LLC is NOT soliciting this investment or making any recommendations by collecting, reviewing, and processing an Investor's documentation for this investment.

DealMaker Securities LLC conducts Anti-Money Laundering, Identity and Bad Actor Disqualification reviews of the Issuer, and confirms they are a registered business in good standing.

DealMaker Securities LLC is NOT vetting or approving the information provided by the Issuer or the Issuer itself.

Contact information is provided for Investors to make inquiries and requests to DealMaker Securities LLC regarding Regulation CF in general, or the status of such investor’s submitted documentation, specifically. DealMaker Securities LLC may direct Investors to specific sections of the Offering Circular to locate information or answers to their inquiry but does not opine or provide guidance on issuer related matters.

THIS WEBSITE MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY'S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS "ESTIMATE," "PROJECT," "BELIEVE," "ANTICIPATE," "INTEND," "EXPECT" AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT'S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY'S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

DISCLAIMER: Equity crowdfunding investments in private placements, and start-up investments in particular, are speculative and involve a high degree of risk and those investors who cannot afford to lose their entire investment should not invest in start-ups. Companies seeking startup investment through equity crowdfunding tend to be in earlier stages of development and their business model, products and services may not yet be fully developed, operational or tested in the public marketplace. There is no guarantee that the stated valuation and other terms are accurate or in agreement with the market or industry valuations. Further, investors may receive illiquid and/or restricted stock that may be subject to holding period requirements and/or liquidity concerns.

DealMaker Securities LLC, a registered broker-dealer, and member of FINRA | SIPC, located at 4000 Eagle Point Corporate Drive, Suite 950, Birmingham, AL 35242., is the Intermediary for this offering and is not an affiliate of or connected with the Issuer. Please check our background on FINRA's BrokerCheck.

DealMaker Securities LLC does not make investment recommendations.

DealMaker Securities LLC is NOT placing or selling these securities on behalf of the Issuer.

DealMaker Securities LLC is NOT soliciting this investment or making any recommendations by collecting, reviewing, and processing an Investor's documentation for this investment.

DealMaker Securities LLC conducts Anti-Money Laundering, Identity and Bad Actor Disqualification reviews of the Issuer, and confirms they are a registered business in good standing.

DealMaker Securities LLC is NOT vetting or approving the information provided by the Issuer or the Issuer itself.

Contact information is provided for Investors to make inquiries and requests to DealMaker Securities LLC regarding Regulation CF in general, or the status of such investor’s submitted documentation, specifically. DealMaker Securities LLC may direct Investors to specific sections of the Offering Circular to locate information or answers to their inquiry but does not opine or provide guidance on issuer related matters.

THIS WEBSITE MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY'S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS "ESTIMATE," "PROJECT," "BELIEVE," "ANTICIPATE," "INTEND," "EXPECT" AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT'S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY'S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

DISCLAIMER: Equity crowdfunding investments in private placements, and start-up investments in particular, are speculative and involve a high degree of risk and those investors who cannot afford to lose their entire investment should not invest in start-ups. Companies seeking startup investment through equity crowdfunding tend to be in earlier stages of development and their business model, products and services may not yet be fully developed, operational or tested in the public marketplace. There is no guarantee that the stated valuation and other terms are accurate or in agreement with the market or industry valuations. Further, investors may receive illiquid and/or restricted stock that may be subject to holding period requirements and/or liquidity concerns.

DealMaker Securities LLC, a registered broker-dealer, and member of FINRA | SIPC, located at 4000 Eagle Point Corporate Drive, Suite 950, Birmingham, AL 35242., is the Intermediary for this offering and is not an affiliate of or connected with the Issuer. Please check our background on FINRA's BrokerCheck.

DealMaker Securities LLC does not make investment recommendations.

DealMaker Securities LLC is NOT placing or selling these securities on behalf of the Issuer.

DealMaker Securities LLC is NOT soliciting this investment or making any recommendations by collecting, reviewing, and processing an Investor's documentation for this investment.

DealMaker Securities LLC conducts Anti-Money Laundering, Identity and Bad Actor Disqualification reviews of the Issuer, and confirms they are a registered business in good standing.

DealMaker Securities LLC is NOT vetting or approving the information provided by the Issuer or the Issuer itself.

Contact information is provided for Investors to make inquiries and requests to DealMaker Securities LLC regarding Regulation CF in general, or the status of such investor’s submitted documentation, specifically. DealMaker Securities LLC may direct Investors to specific sections of the Offering Circular to locate information or answers to their inquiry but does not opine or provide guidance on issuer related matters.

THIS WEBSITE MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY'S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS "ESTIMATE," "PROJECT," "BELIEVE," "ANTICIPATE," "INTEND," "EXPECT" AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT'S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY'S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

DISCLAIMER: Equity crowdfunding investments in private placements, and start-up investments in particular, are speculative and involve a high degree of risk and those investors who cannot afford to lose their entire investment should not invest in start-ups. Companies seeking startup investment through equity crowdfunding tend to be in earlier stages of development and their business model, products and services may not yet be fully developed, operational or tested in the public marketplace. There is no guarantee that the stated valuation and other terms are accurate or in agreement with the market or industry valuations. Further, investors may receive illiquid and/or restricted stock that may be subject to holding period requirements and/or liquidity concerns.

DealMaker Securities LLC, a registered broker-dealer, and member of FINRA | SIPC, located at 4000 Eagle Point Corporate Drive, Suite 950, Birmingham, AL 35242., is the Intermediary for this offering and is not an affiliate of or connected with the Issuer. Please check our background on FINRA's BrokerCheck.

DealMaker Securities LLC does not make investment recommendations.

DealMaker Securities LLC is NOT placing or selling these securities on behalf of the Issuer.

DealMaker Securities LLC is NOT soliciting this investment or making any recommendations by collecting, reviewing, and processing an Investor's documentation for this investment.

DealMaker Securities LLC conducts Anti-Money Laundering, Identity and Bad Actor Disqualification reviews of the Issuer, and confirms they are a registered business in good standing.

DealMaker Securities LLC is NOT vetting or approving the information provided by the Issuer or the Issuer itself.

Contact information is provided for Investors to make inquiries and requests to DealMaker Securities LLC regarding Regulation CF in general, or the status of such investor’s submitted documentation, specifically. DealMaker Securities LLC may direct Investors to specific sections of the Offering Circular to locate information or answers to their inquiry but does not opine or provide guidance on issuer related matters.

THIS WEBSITE MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY'S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS "ESTIMATE," "PROJECT," "BELIEVE," "ANTICIPATE," "INTEND," "EXPECT" AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT'S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY'S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.